Vancouver, British Columbia, October 17, 2024 – Golden Spike Resources Corp. (CSE: GLDS) (OTCQB: GSPRF) (Frankfurt: L5Y) (“Golden Spike” or the “Company”) is pleased to announce the results of Induced Polarization/Resistivity (“IP”) surveys completed at its 100%-owned Gregory River copper-gold property in western Newfoundland (“the Property”). The IP surveys were designed to target volcanogenic massive sulphide (“VMS”) mineralization, as well as vein-hosted and disseminated sulphides, and the results have been very positive, identifying multiple, high-priority chargeability and resistivity anomalies. The IP results, in conjunction with compiled geological and geochemical data, historical drilling data, and a previous IP survey at Lode 9, have been used to generate proposed drill hole locations at Steep Brook, Lode 9 and the Vein Zone. Drill pad construction teams are currently mobilizing to site, and the Company is expecting to commence its inaugural diamond drilling program later this month.

Highlights:

Golden Spike's President and CEO, Keith Anderson, commented: "We are really excited to have completed the first phase of our 2024 exploration program, which included IP surveys over two of our Priority Target areas, Steep Brook and the Vein Zone, and to have received modelling and interpretation results of last year’s IP survey from Lode 9. All three of these areas produced very strong IP responses in areas with coincident geological and geochemical anomalies, allowing us to generate compelling drill targets. With drill pad construction underway and the drills soon to mobilize to the Property, we are now very close to beginning the Company’s inaugural drilling stage.”

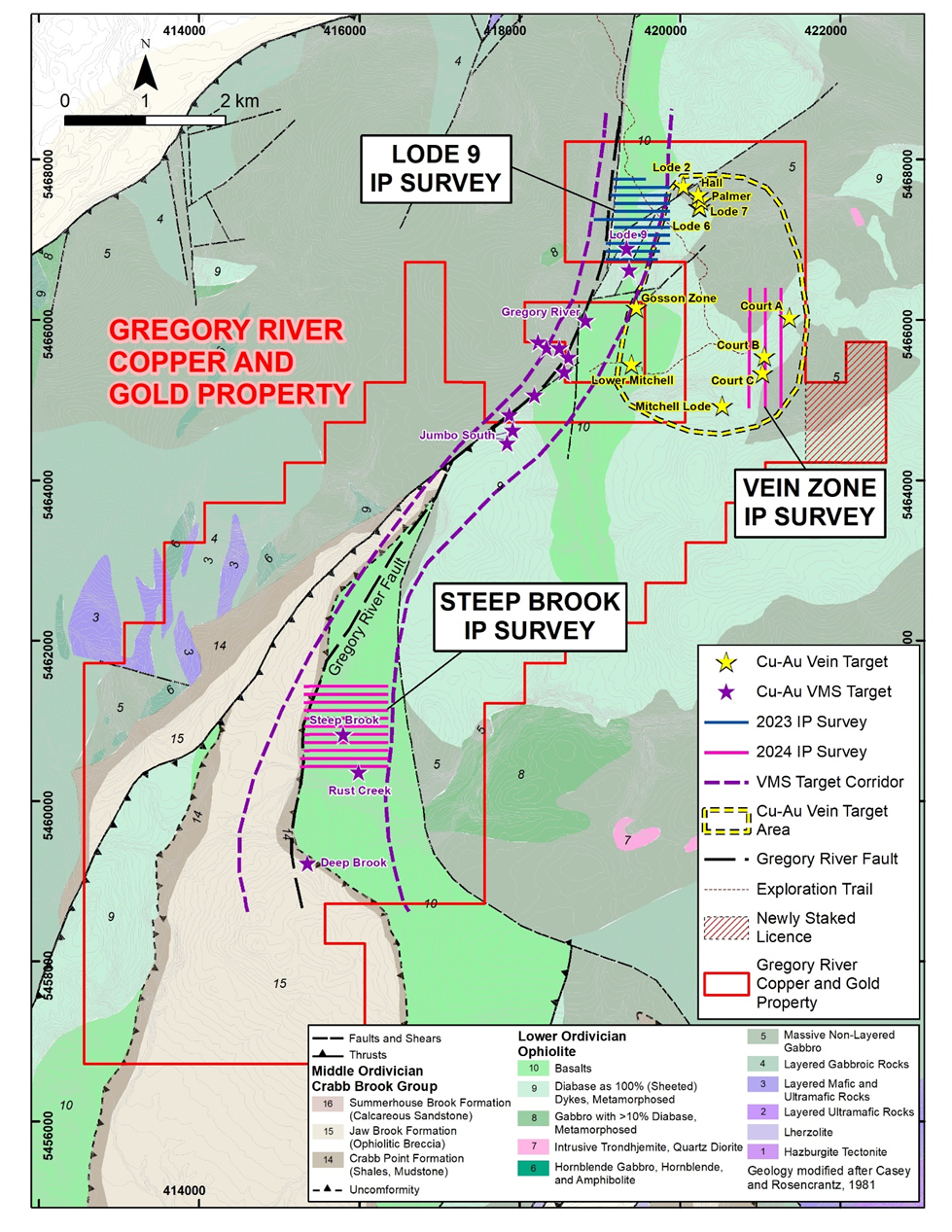

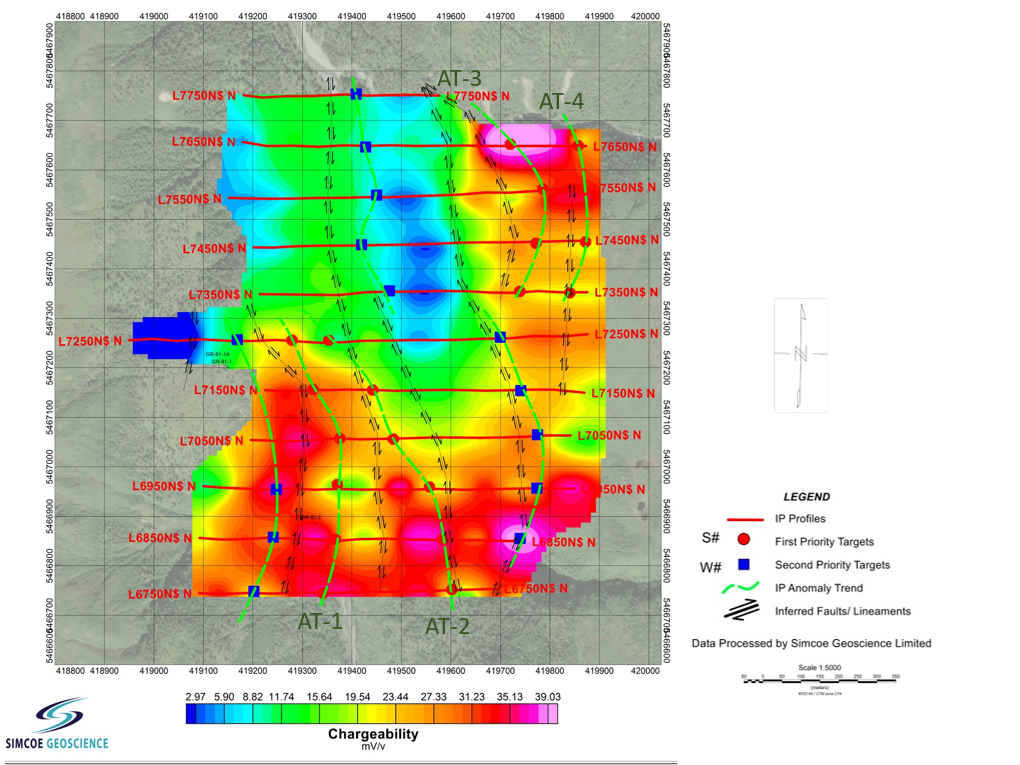

The recent IP surveys at Steep Brook (11 line-km) and the Vein Zone (4.5 line-km) (Figure 1) were completed by Simcoe Geoscience (“Simcoe”), based out of Stouffville, Ontario, between July 14 and August 5, 2024, using their “Wireless” Time Domain Distributed IP Technology (refer to press release “Golden Spike Announces Successful Completion of 2024 Phase 1 Exploration Program at Gregory River, August 19, 2024”). The data was collected using a “dipole-pole-dipole (Reverse & Forward)” configuration with a 50 metre (“m”) station spacing and extra current injections at both ends of the profiles for additional depth penetration. This achieved depths of investigation exceeding 300 m at Steep Brook and 400 m at the Vein Zone. Simcoe also re-processed and interpreted the IP data from the 2023 survey over the Lode 9 target (refer to press release “Golden Spike Announces IP Survey Results over the Gregory River Property”, October 24, 2023) and generated priority IP targets at all three areas.

Figure 1: Gregory River Property – Areas of IP Surveys for 2024 Exploration Program

Steep Brook IP Survey

Steep Brook is located in the southern portion of the VMS target corridor (Figure 1) and is underlain by a north-northeast trending sequence of the Lower Ordovician-aged basaltic flows and related volcaniclastic rocks with widespread chlorite +/- silica-carbonate alteration. These rock units are thought to define part of a broad, gently plunging syncline, with associated local anticlinal fold pairs. Outcrop exposure is limited to a few creek beds, where intermittent outcrops of disseminated, veinlet hosted and semi massive chalcopyrite-pyrite mineralization have been mapped. Previous interpretations suggest that this mineralization could represent a footwall, copper rich stringer zone to an as yet undiscovered copper-gold-zinc massive sulphide deposit.

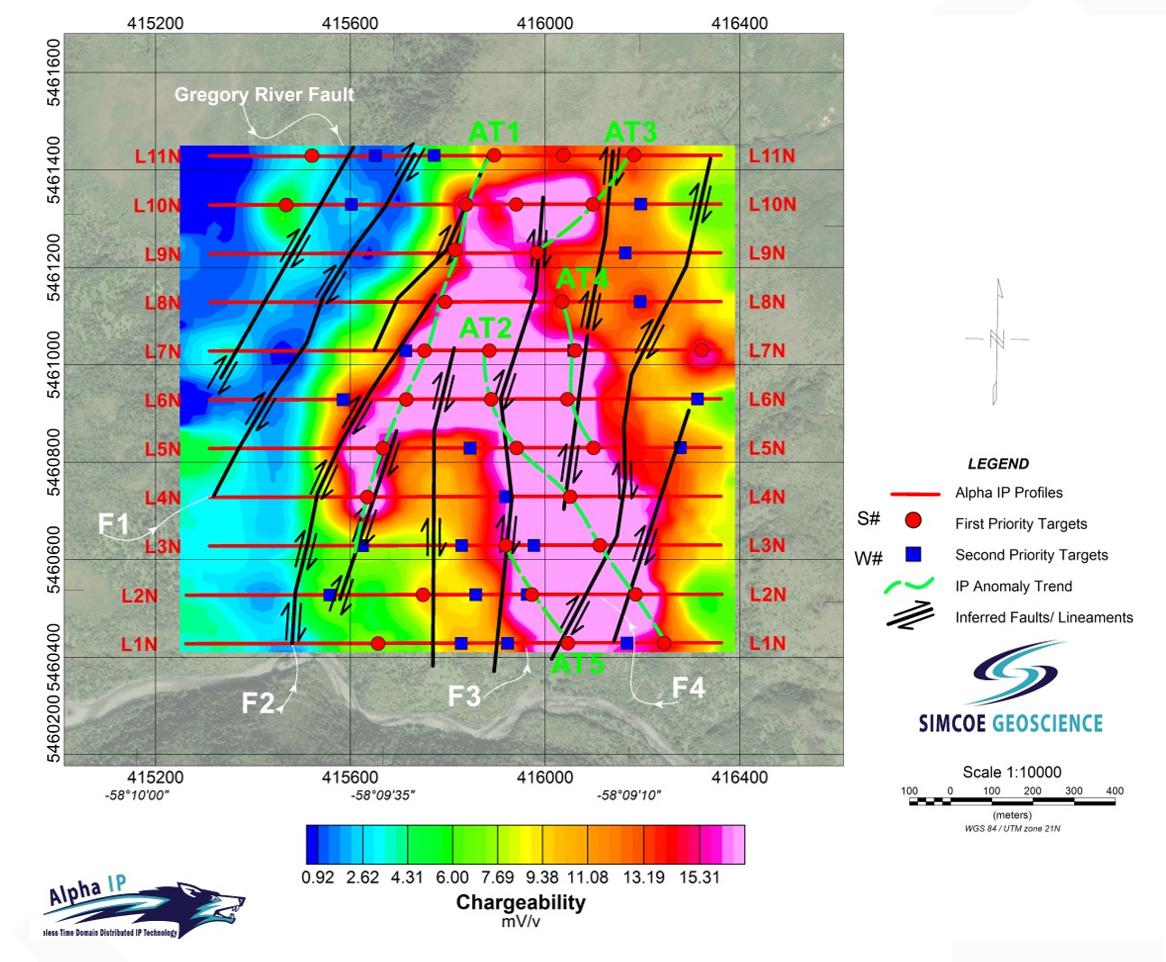

The Steep Brook IP survey included 11, east-west oriented lines, each 1,000 m in length and separated by 100 m. The survey revealed a “corridor” of subparallel, variably oriented, anomaly trends that cover the entire 1,000 m length of the IP survey, over a width of approximately 375 m, and remains open to the north and south (Figure 2). The two major anomaly trends, AT1 and AT2, can be traced over lengths of 700 m northeast, and 600 m northwest, respectively and along these trends are a total of 15 first priority, IP generated targets. In addition, there are three, shorter anomaly trends, AT3, AT4 and AT5 that have interpreted lengths of 200 to 300 m and contain ten additional first priority targets. Surface projection of the IP anomaly trends coincides with the >100 ppm copper soil anomalies (historically collected by Noranda in 1991) and multiple historical rock samples that assayed up to 19.6% copper (average 3.3%), 27.4 g/t Au (average 1.06 g/t Au), 11.1 % Zn (average 0.23%), and 20.3 g/t Ag (average 5.2 g/t Ag).

According to interpretations by Simcoe, the First Priority IP anomalies are generally of moderate size (≥100m x 100m) and exhibit a moderate-to-strong increase in chargeability response (>6 mV/v), accompanied by a marked decrease in resistivity (<2000 Ohm-meters). These anomalies are at moderate depths and interpreted to be consistent with disseminated to semi-massive sulphide with potential for VMS and Cu-Au vein mineralization.

Golden Spike is planning to drill approximately 6 holes, totaling 1,000-1,200 m testing several of these first priority IP anomalies at Steep Brook.

Vein Zone IP Survey

The Vein Zone is located in the northeast portion of the Property (Figure 1) and is mostly covered by a veneer of soil and till, with only a few outcrops exposed along ridges and in creek beds. Where exposed, mineralization is dominated by a series of northwest to southwest striking quartz-carbonate-sulphide veins that range from approximately 0.5 m to 2 m in width, and locally as much as 5 m - 6 m. Copper grades are of the veins very high and range between approximately 1% to 25% copper (average ~2% to 6% copper), along with associated gold (ranging between 0.1 g/t and 3 g/t) and anomalous values of zinc and arsenic. Work by the Company confirms that historical surface sampling might not have tested the full potential width of the vein systems and that historical drilling from the 1950’s at Court A only sampled the highest-grade portion of the veins, leaving most of surrounding host rock unsampled. The Company believes that potential exists for wider, mineralized haloes to surround the main veins and for the discovery of new veins hidden below surface soil and till cover.

Figure 2: Steep Brook – Plan View of IP Anomaly Trends (Chargeability Depth Slice 100m)

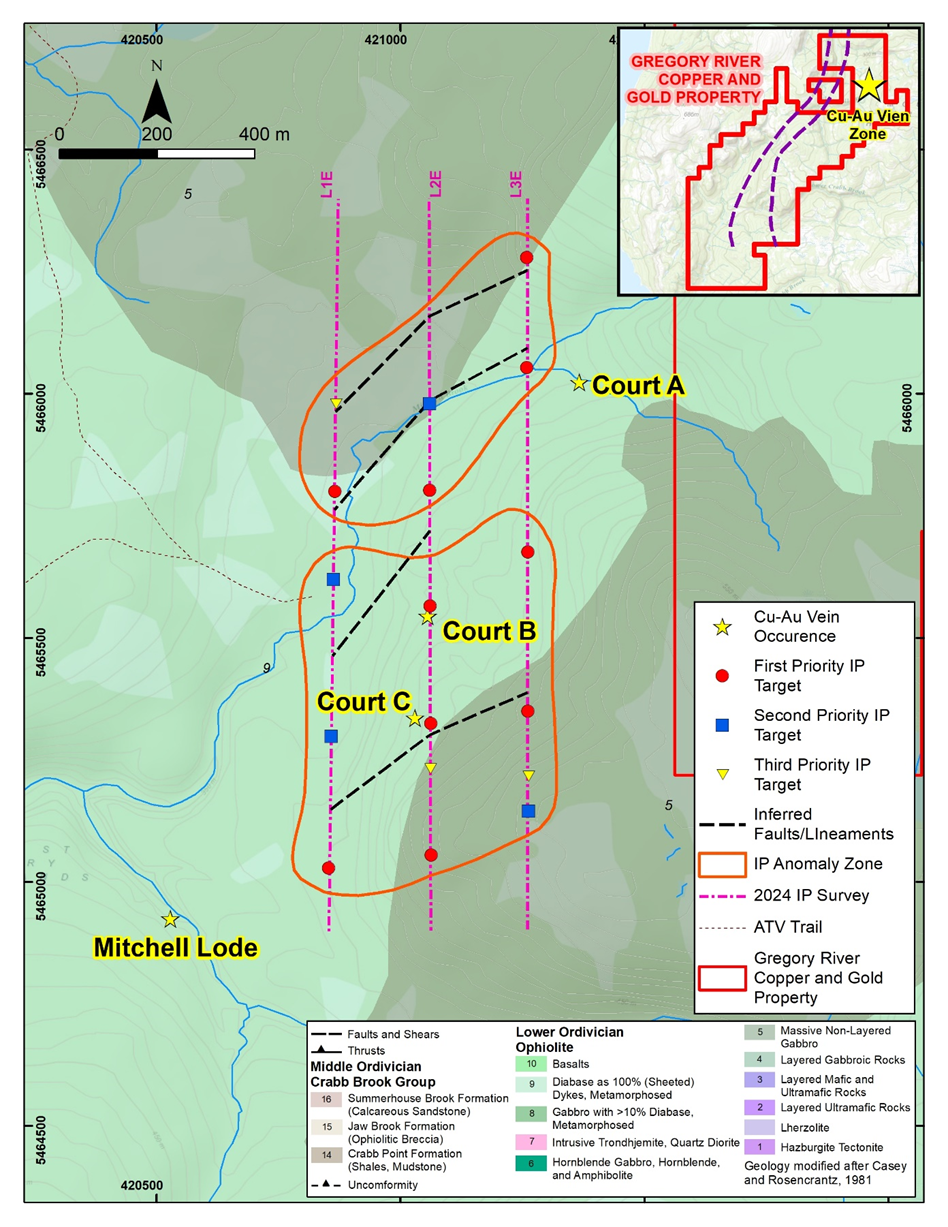

The IP grid is in the southeast corner of the Vein Zone and is comprised of three, 1,500 m long, north trending lines, separated by 200 m. The survey was designed as a test to determine the effectiveness of IP as an exploration technique for the vein-style mineralization and whether the mineralized envelope could be wider than the historical sampling indicated.

The IP response at the Vein Zone was very positive, revealing 10 first-priority targets, as well as 4 second priority, and 3 third priority targets (Figure 3). These targets are all grouped into two interpreted “anomaly zones”, AZ-1 and AZ-2 (Figure 3) and are believed to be sourced from deep, potentially mineralized intrusive bodies/structures. The shallower chargeability anomalies are the focus of this upcoming drill program and are generally steeply dipping, with strong-to-moderate intensity, and often associated with low-to-moderate resistivity responses.

Figure 3: Vein Zone – Plan View of IP Anomalies

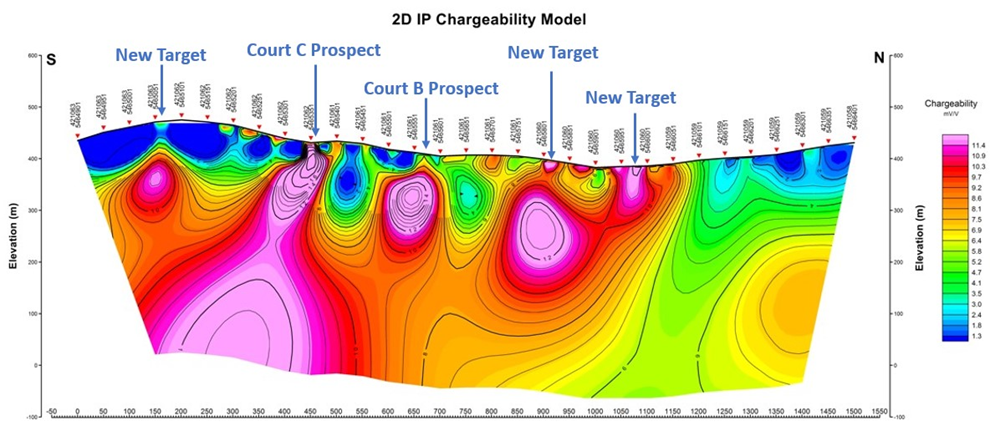

Figure 4 is a modelled chargeability cross section (Line 2E) that crosses the outcrop exposures of the Court A and Court B prospects and continues to the north and south. It is very encouraging to note that many of the chargeability responses are coincident with (located directly below) these vein prospects and the associated soil anomalies (refer to press release “Golden Spike Announces Soil Sampling Results and Receipt of Exploration Permits, March 6, 2023). In addition, the width of the chargeability anomalies appears to be wider than the surface exposure of the vein and some of the chargeability anomalies continue for several hundred metres at depth, suggesting the potential for a wider mineralized system with significant depth extent. Finally, the IP survey has also uncovered strong chargeability anomalies in areas with no outcrop exposure, and these could represent new veins.

Golden Spike is planning to drill approximately 4 holes, totaling 800-900 m testing several of these first priority IP anomalies at Steep Brook.

Figure 4: Vein Zone – 2D Chargeability Model Section Line 2E (section looking west)

Lode 9 IP Modelling and Interpretation

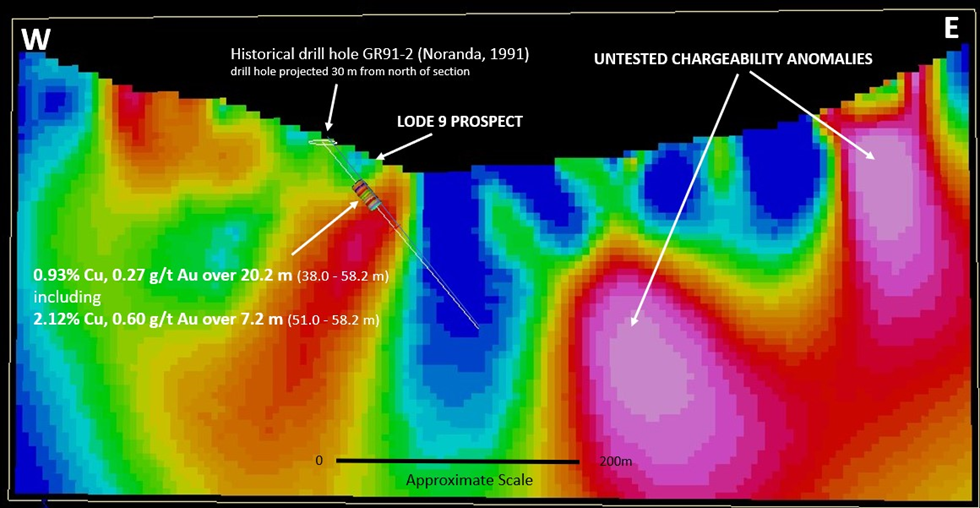

Simcoe was also retained to reprocess the Lode 9 IP data, previously collected during a 2023 IP survey. Simcoe has inverted the data and completed modelling and interpretation resulting in several strong IP anomalies.

The Lode 9 area was previously explored by RioCanex (a subsidiary of Rio Tinto) in 1981 and by Noranda during the early 1990’s. Both companies identified the Lode 9 target as an area with the potential to host stratabound VMS mineralization. RioCanex sampled the Lode 9 prospect, returning grades in the range of 4.04 % copper and 0.72 g/t gold over 2.1 m, 2.52% copper and 0.58 g/t gold over 1.5 m, and 2.04% copper and 0.41 g/t gold over 1.2 m. Later, Noranda undertook extensive exploration, including soil surveys, geological mapping, ground geophysical surveys (magnetics, VLF, HLEM) and 4 diamond drill holes at Lode 9. Hole, GR91-2 was drilled below the Lode 9 prospect and returned 7.2 m grading 2.12% copper and 0.6 g/t gold starting at 51 m depth, within a wider, 20.2 m interval grading 0.93% copper and 0.27 g/t gold, starting at 38 m depth.

The recent inversions and modelling of the 2023 IP data at Lode 9 has revealed two, subparallel, north trending, first priority anomaly trends, AT1 and AT2, both located in the southern half of the grid (Figure 5). Each of these two trends can be traced over lengths of 500 m and along these trends are a total of 12 first priority, IP generated targets. In addition, there are two, shorter first priority anomaly trends, AT3 and AT4 in the northeast part of the grid that have interpreted lengths of 300 m each and contain eight additional first priority targets. Finally, there are three additional second priority anomaly trends that range from 400m to 500 m in length and contain 14 second priority IP anomalies.

IP survey line 6850N cuts across the surface exposure of the Lode 9 prospect and historical drill hole GR91-2. A strong, steeply west-dipping chargeability anomaly corresponds with both of these features suggesting that the chargeability is picking up the VMS-style mineralization at this location (Figure 6). Golden Spike is proposing to drill approximately 4 holes, totaling 900-1,000 m testing several of these first priority IP anomalies at Lode 9.

Figure 5: Lode 9 – Plan View of IP Anomaly Trends (Chargeability Depth Slice 100m)

Figure 6: Lode 9 – 2D Chargeability Model Section Line 6850N (section looking north)

2024 Phase 2 Drilling Program

The Company is ready to commence the second phase of its 2024 exploration program with a diamond drilling program. The program will include approximately 14 holes, totaling 3,000 m, split between Steep Brook, Lode 9 and the Vein Zone. The drill holes will test selected First Priority IP targets that have strong support from other layers of exploration data, including geological interpretations, geochemical information, historical drilling, and airborne magnetic data. All required permits are in place and a team has mobilized to the area to start the construction of drill platforms. The drill is expected to arrive in the second half of October.

Claim Staking

The Company is pleased to announce that it has staked an additional mineral licence (Mineral Licence Number 038490M) covering 125 hectares (“ha”) adjacent to the eastern edge of Property (Figure 1) in the southern part of the Vein Zone.. The licence was staked on behalf of the Company on October 9, 2024, and comprises an aggregate of 5 mineral claims, and brings the total area of the Property to approximately 5,175 ha (12,788 acres). There is no recorded historical work on the new licence, however it does provide for additional land covering any potential extensions to the southern part of the Vein Zone mineralization. The ground will be prospected during upcoming exploration phases.

JEA Program

Golden Spike Resources Corp. is deeply appreciative of being selected as a recipient of the Newfoundland Junior Exploration Assistance (JEA) Program. This funding represents a crucial step in advancing our exploration initiatives in Newfoundland, and we are incredibly grateful for the support provided by the Government of Newfoundland and Labrador. This opportunity strengthens our commitment to responsible and innovative exploration in the region, and we look forward to the positive impact this assistance will have on our efforts. We thank the government for their trust and confidence in our vision and ongoing work.

Qualified Person

The scientific and technical information in this news release has been reviewed and approved for disclosure by Mr. Robert Cinits, P.Geo, a director of the Company and a "Qualified Person" within the meaning of National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

About Golden Spike

Golden Spike Resources Corp. (CSE:GLDS), (OTCQB: GSPRF), (Frankfurt: L5Y) is a Canadian mineral exploration company focused on identifying, acquiring and unlocking value in mineral opportunities in Canada and other low-risk jurisdictions. The Company currently holds 100% interest in the 5,175-hectare Gregory River Property in Newfoundland, strategically centered over an approximate 11-kilometre-long stretch of the Gregory River VMS-belt, a north-northeast trending corridor of very prospective ground with potential to host Cyprus-type polymetallic VMS deposits. In addition, the Property hosts a cluster of historically explored, high-grade, copper ±gold vein structures.

ON BEHALF OF THE BOARD OF DIRECTORS

Keith Anderson

Golden Spike Resources Corp.

830 - 1100 Melville St.,

Vancouver, BC, V6E 4A6

+1 (604) 786-7774

info@goldenspikeresources.com

www.goldenspikeresources.com

“Neither the Canadian Securities Exchange (the “CSE”) nor its Regulation Services Provider (as that term is defined in policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.”

Cautionary Note Regarding Forward-Looking Statements

This release includes certain statements and information that may constitute forward-looking information within the meaning of applicable Canadian securities laws. Forward-looking statements relate to future events or future performance and reflect the expectations or beliefs of management of the Company regarding future events. Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as “intends” or “anticipates”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “should”, “would” occur.

Additionally, forward-looking information involve a variety of known and unknown risks, uncertainties and other factors which may cause the actual results to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: the volatility of global capital markets, political instability, unanticipated costs, risks relating to the extent and duration of the conflict in Eastern Europe and its impact on global markets, the lack of availability of capital and financing, general economic, market or business conditions, adverse weather conditions, failure to maintain all necessary government permits, approvals and authorizations, failure to maintain community acceptance (including First Nations), increase in costs, litigation, failure of counterparties to perform their contractual obligations, failure of the exploration program, including the recent IP survey and potential future drilling to result in the discovery of significant precious and/or base metal mineralization, and those risks, uncertainties and factors set forth in the Company’s disclosure record under the Company’s profile on SEDAR+ at www.sedarplus.ca . Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information contained herein. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement or forward-looking information disclosed herein, except in accordance with applicable securities laws.

Back To Archive